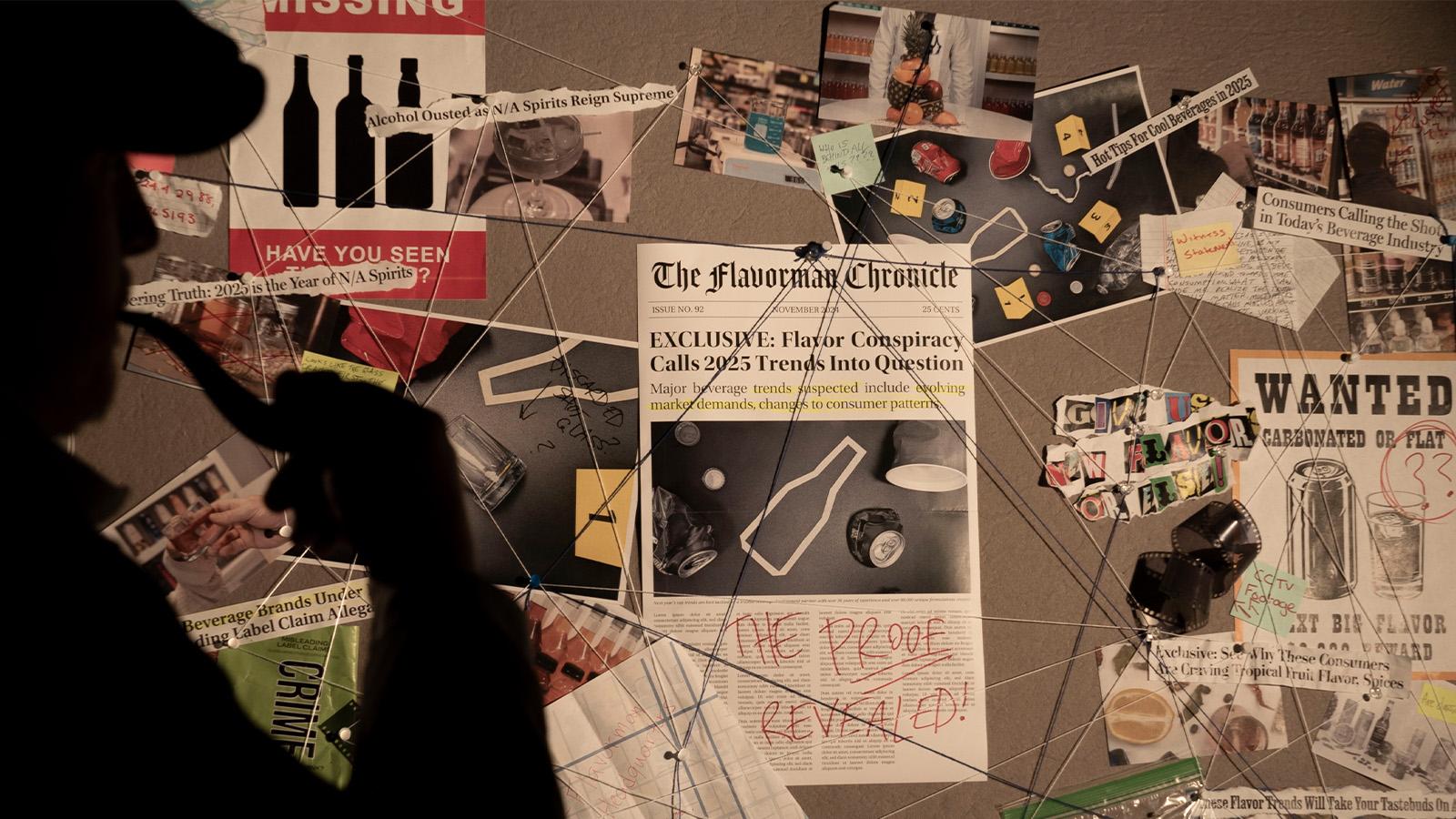

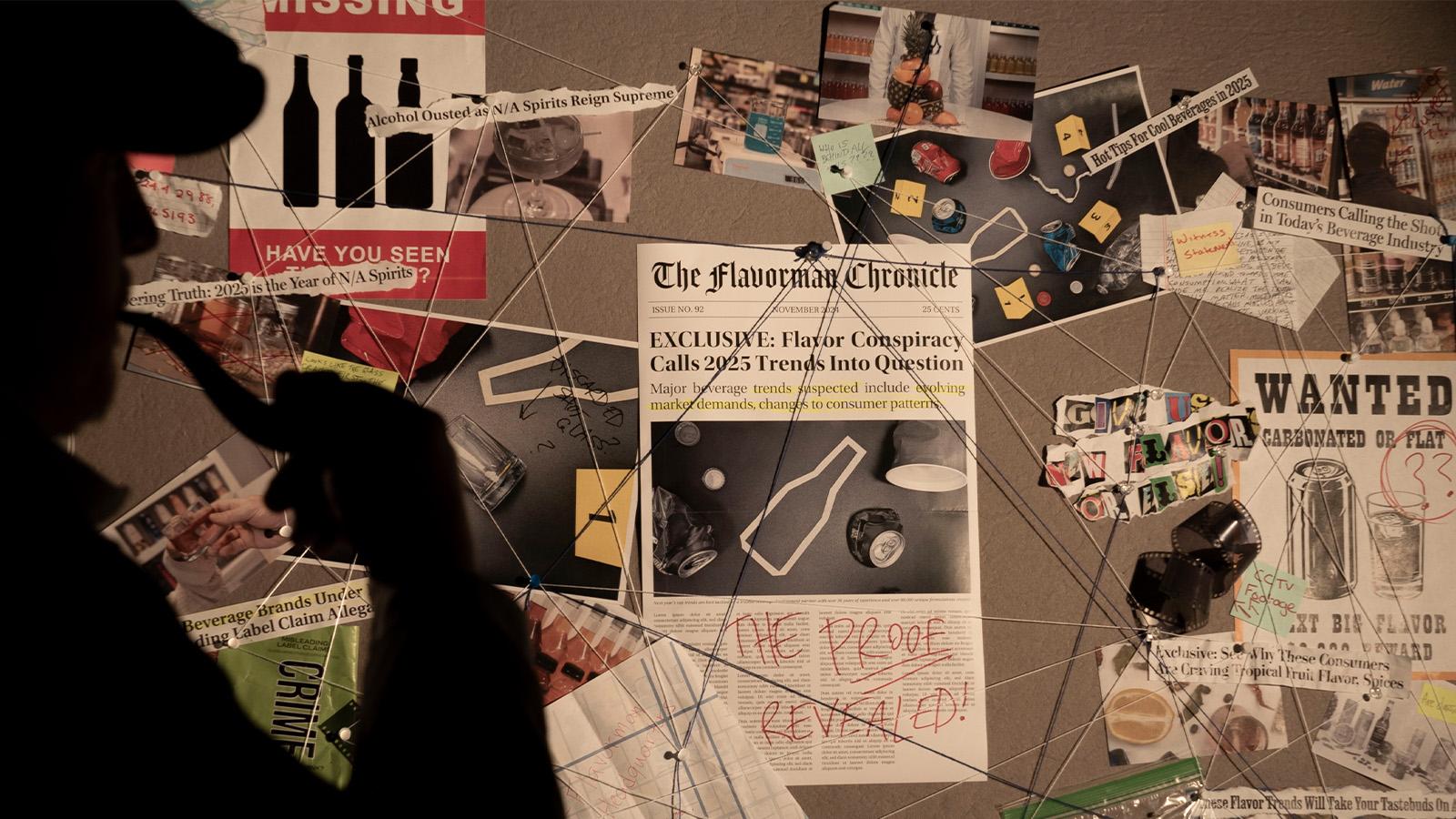

Beverage Trends of 2025

The year 2025 is just around the corner, and the evidence is clear. So, we present a case ready to be served cold, hot, or neat: The Beverage Trends of 2025!

The Latest

With a watchful eye on trends, Flavorman has been leading the way in every category of beverage development. Dig into some of our media below to gain valuable insights into the latest trends, topics and everything in between.

Analytical Testing

Beverage Development

Flavors

The year 2025 is just around the corner, and the evidence is clear. So, we present a case ready to be served cold, hot, or neat: The Beverage Trends of 2025!

No posts found

At its core, Flavorman provides turnkey solutions in product development, reformulation, analytical testing and small scale production, developing solutions for your beverage requirements.

Learn MoreMoonshine University is the nation's premier educational distillery and the exclusive provider for the Kentucky Distillers' Association. Located in the heart of Bourbon Country, Louisville KY.

Learn MoreStave & Thief Society is the first bourbon certification program recognized by the bourbon industry and the only to be recognized by the Kentucky Distillers Association as its 'Official Bourbon Education Course.'

Learn More